Bharati Airtel Limited, commonly known as Airtel, is an Indian global telecommunication service company and one of the top providers of telecommunication service across Asia, Africa and Channel Islands [1]. The company, which was India’s largest operator till a year ago, lost its spot to Reliance Jio which stormed into the telecom sector in September 2016 with its disruptive voice and data offerings [2].

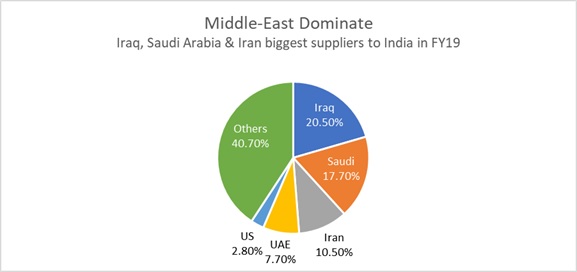

On one hand, we have the worst time for India’s automobile sector and on the other, the telecom sector is set to boom as telecom tower tenancy ratio will increase from 1.95 times in 2016 to 2.9 times by 2020 due to the expansion of 3G, 4G and the onset of 5G technologies [3]. “Data is the new oil” says Mukesh Ambani, Chairman of Reliance Industries and Founder of Reliance Jio, who entered the telecom sector with the launch of Reliance Jio, shook up India’s telecom market and grabbed the number one position by revenue within just three years.

Is Reliance Jio creating a monopoly in the market? Jio aims at creating an entire digital ecosystem, offering services almost in every telecom application. Increasing customer base by providing attractive offers was always their strategy of expansion. Jio’s mega plan, Jio GigaFiber, can disrupt the home internet space just the same way it transformed the mobile internet landscape. It is constantly expanding its customer base by proposing “Welcome Offers” through free subscription to Hotstar, free HD or 4K LED TV and 4K Jio set-top box, and a ‘First Day First Show’ feature expected to be launched by 2020 which would enable premium subscribers to stream new movies on the day of their theatrical release [4].

Jio has triggered a broadband war with other telecom operators, and which Gladiator would turn out to the champion in this war will be decided by no one else but the customers. Consumers are attracted towards cashbacks, free goodies, and convenient services which carry a low switching cost. Jio has indirectly made it inevitable for other operators to come up with new services to increase and retain their customer base.

Airtel has returned fire by providing new offers in response to Reliance Jio’s disruptive broadband services. Airtel is coming up with the Omni-Channel strategy to entice all types of users from Mobile Services, Direct-to-Home TV to Broadband, with a range of super-premium tariff packs. The operator is tying up all loose ends to beat Reliance Jio’s offerings. For starters, the telco would offer an Android-based Smart Set-Top Box with high-speed broadband, free LED TV, which may also be bundled with various digital plans in ways similar to Jio’s.

From the point of view of coverage, even if Jio has reached a number of rural villages in India, considering data speeds Airtel fares better than Jio. Therefore, Airtel can certainly leverage this capability to target rural areas. A good and stable high-speed internet service can aid seamless access to the internet at home, schools, colleges and business places. This can help Airtel to have an edge over Jio with its sizeable customer base across post-paid mobile, DTH, broadband services, etc. Airtel has also merged with Tata Teleservices to expand their customer base and gain wider access to the 4G spectrum. This deal will again help Airtel to compete with Jio.

Customers now-a-days demand not only high speed data access, but also an uninterrupted service at the lowest price point. Therefore, value-rich tariff plans that would carry its seamless services across wider geographies would aid Airtel in its game plan to attract new customers and retain existing ones, thereby sustaining and improving its revenues and overall growth.

Written by: Sayali Nadhe

PGPM “Spartan” Class 2020

Great Lakes Institute of Management, Gurgaon

Sources:

[1]: https://www.statista.com/topics/4859/airtel/