An investment in Reliance Group, rather the biggest one in its 53-year history, might just result in one of the largest ever foreign investment by any overseas company into India. This investor is none other but Saudi Aramco, which is not only the world’s largest and lowest cost-per-barrel producer of crude oil but also the most profitable company in the world [1]. This company is in talks to invest a handsome amount in the largest private-sector corporation in India.

The relationship between Saudi Aramco and Reliance Industries has already been a long one, 25 years to be specific. Saudi Aramco has already supplied 2 billion barrels of crude oil for processing at RIL’s refinery at Jamnagar till date. A potential 20% stake in the Oil-to-Chemical division comprising of Refining, Petrochemicals and Fuel Marketing Business of Reliance Industries carries an Enterprise Value of US $75 billion [2]. This deal will also result in Saudi Aramco supplying 5,00,000 barrels of Crude oil per day to Jamnagar refinery on a long-term basis [3].

However, the deal didn’t really have a great start. It fell apart on multiple occasions with Reliance demanding a higher valuation which, indeed, they were able to command with a much higher multiple than industry standards. As a part of the deal, Reliance industries will carve its oil-to-chemicals division and will become an independent entity in 5 years. However, for the first 5 years, Saudi Aramco will not directly own shares in the business division, though it will get a chance to appoint a key business leader, tentatively the COO, to oversee it [4]. Apart from this, Saudi Aramco has been on an acquisition spree and making other major investments in Asia to bolster its presence, building refineries in Indonesia, South Korea, China, and Malaysia.

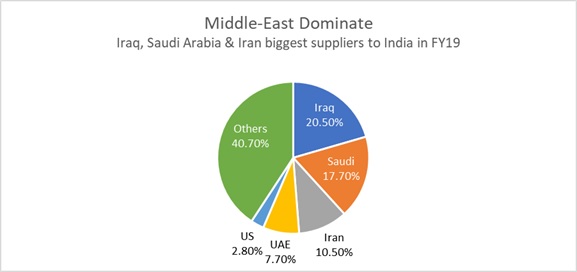

To put things in perspective, Saudi Arabia’s oil export to the US was ~2,62,053 BPD in July 2019, nearly 62% down from 6,87,946 BPD as compared in August 2018, as a result of the US becoming self-reliant than ever [5]. This has resulted from the US Shale Oil Revolution and has been one of the major reason of OPEC production cut in 2017, resulting in reduced supply to the largest, transparent and timeliest market – The US. At the same time, according to a report by Wood Mackenzie, India will surpass China to become the second-largest oil demand growth center in 2019 remaining only behind the US and helping them offset a slowdown elsewhere through growth in Indian markets [6].

On the backdrop, this deal seems to be a perfect solution for Saudi Aramco to maintain stronghold and grip on the fastest-growing oil market in the world (bolstered by the swelling middle class) where it is facing stiff competition. By competition, we also mean the US, which is ramping up shale exports, and Russia who is looking for new customers and trying to making inroads

Stepping into Mr. Mukesh Ambani’s shoes and understanding the story from his perspective, the deal will provide Reliance with the much-required cash to de-leverage its balance sheet, bring net debt to zero by March 2021, and fund the Jio and Digital business [7]. This is part of the company’s larger effort to expand its consumer-facing business including its retail chain, and its effort to move into the technology sector and internet services by diversifying from its core oil refining and petrochemical business. This deal seems to be a perfect synergy between the interests of the world’s largest oil producer and the ambitions of one of India’s largest conglomerates.

Written by: Surya Jain – PGDM “Apache” Class of 2021

Great Lakes Institute of Management, Gurgaon

References

[1]: https://www.linkedin.com/feed/news/the-worlds-most-profitable-company-4984378/

[3]: https://www.vccircle.com/reliance-to-sell-20-stake-in-oil-to-chemicals-business-to-saudi-aramco